Choose the checking account that works best for you.  Without it, some pages won't work properly. She has been doing research on how might they pre-validate account information before processing payments to help directly address these issues. Business owners need to supply the following documents and information to open a Chase business checking account: Two forms of identification, including a government-issued photo ID. Plus, get your free credit score! Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. To learn more, visit the Banking Education Center. We work hard to protect your information. That's why we ask you to sign in to chase.com or the Chase Mobile app to see your accounts on your desktop or mobile device. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you're new to chase.com or Chase for Business, choose "Not enrolled? Choose the checking account that works best for you. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Enroll in Chase Online or on the Chase Mobile app. Mobile and online banking tools: Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle.

Without it, some pages won't work properly. She has been doing research on how might they pre-validate account information before processing payments to help directly address these issues. Business owners need to supply the following documents and information to open a Chase business checking account: Two forms of identification, including a government-issued photo ID. Plus, get your free credit score! Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. To learn more, visit the Banking Education Center. We work hard to protect your information. That's why we ask you to sign in to chase.com or the Chase Mobile app to see your accounts on your desktop or mobile device. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you're new to chase.com or Chase for Business, choose "Not enrolled? Choose the checking account that works best for you. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Enroll in Chase Online or on the Chase Mobile app. Mobile and online banking tools: Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle.  JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. and its affiliates worldwide. Apply for auto financing for a new or used car with Chase. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. We might call you if we notice a change in your online activity, but we'll never ask you for personal information over the phone, such as your mother's maiden name or Social Security Number.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. and its affiliates worldwide. Apply for auto financing for a new or used car with Chase. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. We might call you if we notice a change in your online activity, but we'll never ask you for personal information over the phone, such as your mother's maiden name or Social Security Number.  JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. She shares the application with her colleagues and they agree this has the potential to directly address their operational costs. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services. This is Alex, who also works at a large bank that has already joined the Confirm application and is responding to pre-validation requests. Please adjust the settings in your browser to make sure JavaScript is turned on. Seeour Chase Total Checkingoffer for new customers. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Link your external account. For a better experience, download the Chase app for your iPhone or Android. We use internal policies to protect and limit access to your Social Security number and make sure it isn't used inappropriately. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Its never too early to begin saving. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. For a better experience, download the Chase app for your iPhone or Android. While Alex is satisfied his net new revenues continue to grow. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. NerdWallet's business checking reviews look at multiple factors, including monthly fee, APY, ATM access, transaction limits, cash deposit allowance, customer service, additional features and incidental fees, such as overdraft, NSF and stop payment charges. or its affiliates.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. She shares the application with her colleagues and they agree this has the potential to directly address their operational costs. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services. This is Alex, who also works at a large bank that has already joined the Confirm application and is responding to pre-validation requests. Please adjust the settings in your browser to make sure JavaScript is turned on. Seeour Chase Total Checkingoffer for new customers. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Link your external account. For a better experience, download the Chase app for your iPhone or Android. We use internal policies to protect and limit access to your Social Security number and make sure it isn't used inappropriately. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Its never too early to begin saving. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. For a better experience, download the Chase app for your iPhone or Android. While Alex is satisfied his net new revenues continue to grow. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. NerdWallet's business checking reviews look at multiple factors, including monthly fee, APY, ATM access, transaction limits, cash deposit allowance, customer service, additional features and incidental fees, such as overdraft, NSF and stop payment charges. or its affiliates.

For extra security, we might ask you to do this again when you enroll in or start using new products (for example, our wire transfer service). Certain custody and other services are provided by JPMorgan Chase Bank, N.A. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services. Please review its terms, privacy and security policies to see how they apply to you. When evaluating offers, please review the financial institutions Terms and Conditions. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. As a global leader, we deliver strategic advice and solutions, including capital raising, risk management, and trade finance services to corporations, institutions and governments. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Use the payment calculator to estimate monthly payments. You can earn a $300 sign-up bonus if you deposit $2,000 or more within 30 days of opening your account, maintain that balance for 60 days and complete five qualifying transactions, including: MORE: How to choose a bank for your small business. Your statements are available on chase.com and can be seen as long as your auto account is active. When you use these websites to invest or help manage your finances, you'll enter your chase.com username and password directly into a secure chase.com window from their website and you'll only have to give access once. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase Business Complete Checking is best for small-business owners who: Chase Business Complete Checking at a glance, How to open a Chase business checking account, What you need to open a Chase business account, How to choose a bank for your small business, Where Chase Business Complete Checking stands out. Seeour Chase Total Checkingoffer for new customers. available with both brick-and-mortar and online competitors. $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). Bank deposit accounts, such as checking and savings, may be subject to approval. Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. Youll pay 2.6% plus 10 cents for tapped, dipped or swiped transactions and 3.5% plus 10 cents for keyed transactions. Spend a minimum of $2,000 on purchases using a Chase Ink Business Card. Policy Engagement & Political Participation, Dividends and Other Stockholder Inquiries. When you sign in for the first time or with a device we don't recognize, we'll ask you for your username, password and a temporary identification code, which we'll send you by phone, email or text message. He has noticed a lot of new volume on the network, which doubled earnings from Confirm this month. Connect your other accounts to your Chase Mobile app video, SAFE Act: Chase Mortgage Loan Originators. Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Contact your nearest branch and let us help you reach your goals. Leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Please review its terms, privacy and security policies to see how they apply to you. When evaluating offers, please review the financial institutions Terms and Conditions. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. As a global leader, we deliver strategic advice and solutions, including capital raising, risk management, and trade finance services to corporations, institutions and governments. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Use the payment calculator to estimate monthly payments. You can earn a $300 sign-up bonus if you deposit $2,000 or more within 30 days of opening your account, maintain that balance for 60 days and complete five qualifying transactions, including: MORE: How to choose a bank for your small business. Your statements are available on chase.com and can be seen as long as your auto account is active. When you use these websites to invest or help manage your finances, you'll enter your chase.com username and password directly into a secure chase.com window from their website and you'll only have to give access once. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase Business Complete Checking is best for small-business owners who: Chase Business Complete Checking at a glance, How to open a Chase business checking account, What you need to open a Chase business account, How to choose a bank for your small business, Where Chase Business Complete Checking stands out. Seeour Chase Total Checkingoffer for new customers. available with both brick-and-mortar and online competitors. $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). Bank deposit accounts, such as checking and savings, may be subject to approval. Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. Youll pay 2.6% plus 10 cents for tapped, dipped or swiped transactions and 3.5% plus 10 cents for keyed transactions. Spend a minimum of $2,000 on purchases using a Chase Ink Business Card. Policy Engagement & Political Participation, Dividends and Other Stockholder Inquiries. When you sign in for the first time or with a device we don't recognize, we'll ask you for your username, password and a temporary identification code, which we'll send you by phone, email or text message. He has noticed a lot of new volume on the network, which doubled earnings from Confirm this month. Connect your other accounts to your Chase Mobile app video, SAFE Act: Chase Mortgage Loan Originators. Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Contact your nearest branch and let us help you reach your goals. Leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Eligibility for particular products and services will be determined by JPMorgan Chase Bank, N.A. Chase operates more than 4,700 retail branches across 48 states. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. To learn more, visit the Banking Education Center. You might be able to use a portion of your home's value to spruce it up or pay other bills with a Home Equity Line of Credit. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account. Here is a list of our partners. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. If you've given access to one of our partners, you'll see them in Linked Apps and Websites, where you'll be able to remove their access. Mia found Confirm, an application on the Liink network that allows her to pre-validate certain account information directly with another participating bank in near real-time. Use the payment calculator to estimate monthly payments. Check here for the latestJ.P. Morgan online investingoffers, promotions, and coupons.

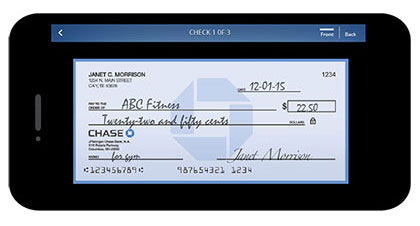

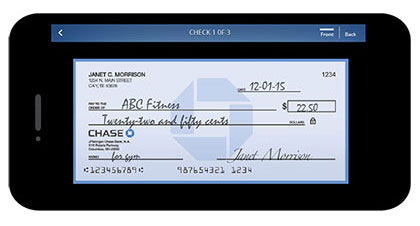

Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. is a wholly-owned subsidiary of JPMorgan Chase & Co. Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle. Earn $300 when you open a new Chase Business Complete Checking account. Chase Bank serves nearly half of U.S. households with a broad range of products. This review and the corresponding star rating focus on Chase Business Complete Checking, which caters most to small-business owners with a low monthly fee ($15), unlimited electronic deposits and a focus on digital tools.

Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. If you plan on writing paper checks or making teller-deposits frequently, the business complete checking account may not meet your needs. To find out if you may be eligible for a HELOC, use our HELOC calculatorand other resourcesfor a HELOC. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. is a wholly-owned subsidiary of JPMorgan Chase & Co. Connect your other accounts to your Chase Mobile app. Open the See interest paid letter link and choose the printer icon to print. You can also call us, visit one of our branches or send it by U.S. mail. Institutions can inquire about validation of an account prior to initiating payment, respond to inquiries for account owner and status, or participate as both an inquirer and a responder. Where Chase Business Complete Checking falls short, Chase Business Complete Checkings $15 monthly fee is a hard pill to swallow, especially considering the number of.

Without it, some pages won't work properly. She has been doing research on how might they pre-validate account information before processing payments to help directly address these issues. Business owners need to supply the following documents and information to open a Chase business checking account: Two forms of identification, including a government-issued photo ID. Plus, get your free credit score! Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. To learn more, visit the Banking Education Center. We work hard to protect your information. That's why we ask you to sign in to chase.com or the Chase Mobile app to see your accounts on your desktop or mobile device. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you're new to chase.com or Chase for Business, choose "Not enrolled? Choose the checking account that works best for you. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Enroll in Chase Online or on the Chase Mobile app. Mobile and online banking tools: Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle.

Without it, some pages won't work properly. She has been doing research on how might they pre-validate account information before processing payments to help directly address these issues. Business owners need to supply the following documents and information to open a Chase business checking account: Two forms of identification, including a government-issued photo ID. Plus, get your free credit score! Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. To learn more, visit the Banking Education Center. We work hard to protect your information. That's why we ask you to sign in to chase.com or the Chase Mobile app to see your accounts on your desktop or mobile device. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. If you're new to chase.com or Chase for Business, choose "Not enrolled? Choose the checking account that works best for you. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Enroll in Chase Online or on the Chase Mobile app. Mobile and online banking tools: Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle.  JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. and its affiliates worldwide. Apply for auto financing for a new or used car with Chase. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. We might call you if we notice a change in your online activity, but we'll never ask you for personal information over the phone, such as your mother's maiden name or Social Security Number.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. and its affiliates worldwide. Apply for auto financing for a new or used car with Chase. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. We might call you if we notice a change in your online activity, but we'll never ask you for personal information over the phone, such as your mother's maiden name or Social Security Number.  JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. She shares the application with her colleagues and they agree this has the potential to directly address their operational costs. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services. This is Alex, who also works at a large bank that has already joined the Confirm application and is responding to pre-validation requests. Please adjust the settings in your browser to make sure JavaScript is turned on. Seeour Chase Total Checkingoffer for new customers. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Link your external account. For a better experience, download the Chase app for your iPhone or Android. We use internal policies to protect and limit access to your Social Security number and make sure it isn't used inappropriately. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Its never too early to begin saving. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. For a better experience, download the Chase app for your iPhone or Android. While Alex is satisfied his net new revenues continue to grow. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. NerdWallet's business checking reviews look at multiple factors, including monthly fee, APY, ATM access, transaction limits, cash deposit allowance, customer service, additional features and incidental fees, such as overdraft, NSF and stop payment charges. or its affiliates.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. She shares the application with her colleagues and they agree this has the potential to directly address their operational costs. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services. This is Alex, who also works at a large bank that has already joined the Confirm application and is responding to pre-validation requests. Please adjust the settings in your browser to make sure JavaScript is turned on. Seeour Chase Total Checkingoffer for new customers. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Link your external account. For a better experience, download the Chase app for your iPhone or Android. We use internal policies to protect and limit access to your Social Security number and make sure it isn't used inappropriately. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Its never too early to begin saving. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. For a better experience, download the Chase app for your iPhone or Android. While Alex is satisfied his net new revenues continue to grow. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. NerdWallet's business checking reviews look at multiple factors, including monthly fee, APY, ATM access, transaction limits, cash deposit allowance, customer service, additional features and incidental fees, such as overdraft, NSF and stop payment charges. or its affiliates. For extra security, we might ask you to do this again when you enroll in or start using new products (for example, our wire transfer service). Certain custody and other services are provided by JPMorgan Chase Bank, N.A. You can also set up multiple users on your account, download account activity to financial software and have access to collection and cash-flow services.

Please review its terms, privacy and security policies to see how they apply to you. When evaluating offers, please review the financial institutions Terms and Conditions. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. As a global leader, we deliver strategic advice and solutions, including capital raising, risk management, and trade finance services to corporations, institutions and governments. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Use the payment calculator to estimate monthly payments. You can earn a $300 sign-up bonus if you deposit $2,000 or more within 30 days of opening your account, maintain that balance for 60 days and complete five qualifying transactions, including: MORE: How to choose a bank for your small business. Your statements are available on chase.com and can be seen as long as your auto account is active. When you use these websites to invest or help manage your finances, you'll enter your chase.com username and password directly into a secure chase.com window from their website and you'll only have to give access once. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase Business Complete Checking is best for small-business owners who: Chase Business Complete Checking at a glance, How to open a Chase business checking account, What you need to open a Chase business account, How to choose a bank for your small business, Where Chase Business Complete Checking stands out. Seeour Chase Total Checkingoffer for new customers. available with both brick-and-mortar and online competitors. $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). Bank deposit accounts, such as checking and savings, may be subject to approval. Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. Youll pay 2.6% plus 10 cents for tapped, dipped or swiped transactions and 3.5% plus 10 cents for keyed transactions. Spend a minimum of $2,000 on purchases using a Chase Ink Business Card. Policy Engagement & Political Participation, Dividends and Other Stockholder Inquiries. When you sign in for the first time or with a device we don't recognize, we'll ask you for your username, password and a temporary identification code, which we'll send you by phone, email or text message. He has noticed a lot of new volume on the network, which doubled earnings from Confirm this month. Connect your other accounts to your Chase Mobile app video, SAFE Act: Chase Mortgage Loan Originators. Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Contact your nearest branch and let us help you reach your goals. Leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Please review its terms, privacy and security policies to see how they apply to you. When evaluating offers, please review the financial institutions Terms and Conditions. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. As a global leader, we deliver strategic advice and solutions, including capital raising, risk management, and trade finance services to corporations, institutions and governments. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Use the payment calculator to estimate monthly payments. You can earn a $300 sign-up bonus if you deposit $2,000 or more within 30 days of opening your account, maintain that balance for 60 days and complete five qualifying transactions, including: MORE: How to choose a bank for your small business. Your statements are available on chase.com and can be seen as long as your auto account is active. When you use these websites to invest or help manage your finances, you'll enter your chase.com username and password directly into a secure chase.com window from their website and you'll only have to give access once. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, memberFINRA and SIPC. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase Business Complete Checking is best for small-business owners who: Chase Business Complete Checking at a glance, How to open a Chase business checking account, What you need to open a Chase business account, How to choose a bank for your small business, Where Chase Business Complete Checking stands out. Seeour Chase Total Checkingoffer for new customers. available with both brick-and-mortar and online competitors. $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). Bank deposit accounts, such as checking and savings, may be subject to approval. Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. Youll pay 2.6% plus 10 cents for tapped, dipped or swiped transactions and 3.5% plus 10 cents for keyed transactions. Spend a minimum of $2,000 on purchases using a Chase Ink Business Card. Policy Engagement & Political Participation, Dividends and Other Stockholder Inquiries. When you sign in for the first time or with a device we don't recognize, we'll ask you for your username, password and a temporary identification code, which we'll send you by phone, email or text message. He has noticed a lot of new volume on the network, which doubled earnings from Confirm this month. Connect your other accounts to your Chase Mobile app video, SAFE Act: Chase Mortgage Loan Originators. Chase isnt responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Contact your nearest branch and let us help you reach your goals. Leverages cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice. Eligibility for particular products and services will be determined by JPMorgan Chase Bank, N.A. Chase operates more than 4,700 retail branches across 48 states. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. To learn more, visit the Banking Education Center. You might be able to use a portion of your home's value to spruce it up or pay other bills with a Home Equity Line of Credit. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account. Here is a list of our partners. In our Learning Center, you can see today's mortgage ratesand calculate what you can afford with ourmortgage calculatorbefore applying for a mortgage. If you've given access to one of our partners, you'll see them in Linked Apps and Websites, where you'll be able to remove their access. Mia found Confirm, an application on the Liink network that allows her to pre-validate certain account information directly with another participating bank in near real-time. Use the payment calculator to estimate monthly payments. Check here for the latestJ.P. Morgan online investingoffers, promotions, and coupons.

Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 16,000 ATMs and more than 4,700 branches. is a wholly-owned subsidiary of JPMorgan Chase & Co. Chase mobile and online banking include features such as online bill pay, fraud protection, text banking, account alerts and Chase QuickPay with Zelle. Earn $300 when you open a new Chase Business Complete Checking account. Chase Bank serves nearly half of U.S. households with a broad range of products. This review and the corresponding star rating focus on Chase Business Complete Checking, which caters most to small-business owners with a low monthly fee ($15), unlimited electronic deposits and a focus on digital tools.

Get a mortgage, low down payment mortgage, jumbo mortgage or refinance your home with Chase. If you plan on writing paper checks or making teller-deposits frequently, the business complete checking account may not meet your needs. To find out if you may be eligible for a HELOC, use our HELOC calculatorand other resourcesfor a HELOC. Whether you choose to work with a financial advisorand develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. is a wholly-owned subsidiary of JPMorgan Chase & Co. Connect your other accounts to your Chase Mobile app. Open the See interest paid letter link and choose the printer icon to print. You can also call us, visit one of our branches or send it by U.S. mail. Institutions can inquire about validation of an account prior to initiating payment, respond to inquiries for account owner and status, or participate as both an inquirer and a responder. Where Chase Business Complete Checking falls short, Chase Business Complete Checkings $15 monthly fee is a hard pill to swallow, especially considering the number of.