Hence, it also establishes non-financial standards, which ultimately help in performance evaluation. To learn more about it, refer to RATIO ANALYSIS.

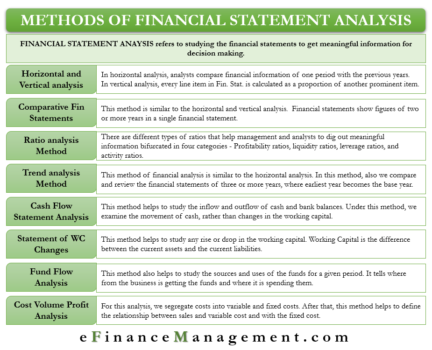

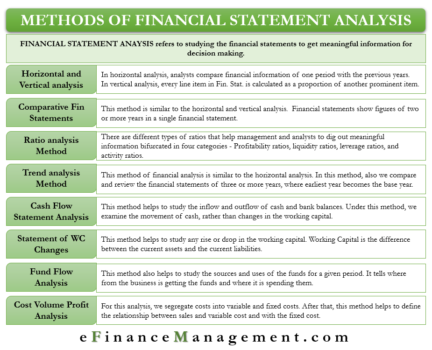

Solvency ratios include the time's interest earned ratio, the debt-to-service ratio, and the debt-to-asset ratio. This entails reviewing financial statements of three or more periods, an extension of horizontal analysis. Adjusting Accounts and Preparing Financial Statements, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis: Definition, Purpose, Elements & Examples, Effective Communication in the Workplace: Help and Review, DSST Business Ethics and Society: Study Guide & Test Prep, Introduction to Management: Help and Review, Intro to PowerPoint: Essential Training & Tutorials, Public Speaking Syllabus Resource & Lesson Plans, FTCE Marketing 6-12 (057): Test Practice & Study Guide, Computing for Teachers: Professional Development, UExcel Principles of Management: Study Guide & Test Prep. The main purpose of financial analysis is to track the progress and performance of the business and evaluate its financial health. Guest post by Lucas Cappel. Working Capital is the difference between the current assets and the current liabilities.

This means that every dollar of sales will generate more profit for Kwik-E-Mart than for Grocery Plus. Log in or sign up to add this lesson to a Custom Course.

Comment on how these companies compare in regards to their profitability. An analyst can also use ratios to identify trends (if any) in the financial numbers. The right side also shows liabilities further categorized into current and noncurrent liabilities, as well as the shareholder's equity, which is the money owed to the owners and investors.

After analysts calculate a ratio (or ratios), they can compare it with the same ratio of previous years. Requirements Discovery ListHow to Start Your BA CareerBA Template ToolkitBA Email Toolkit. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Intuitively, this is usually the first thing we think about with a business we often ask questions such as, How much revenue does it have? Is it profitable? and What are the margins like?.

The earliest year in the set data represents the base year. Your email address will not be published. These are the all major tools and techniques of financial statement analysis.

3. Moreover, fund flow analysis also assists in highlighting changes (if any) in a companys financial structure.

Kwik-E-Mart has a higher liquidity than Grocery Plus. lessons in math, English, science, history, and more. succeed.

SAVAGLIA COMPANY Worksheet (partial) Account Titles Adjusted Trial Balance Income St, Pronto, Inc. is a major producer of printing equipment. 2. 1.

A concept model provides a great way of documenting definitions and communicating precise meanings of terms to stakeholders.

Using the financial ratios derived from the balance sheet and comparing them historically versus industry averages or competitors will help you assess the solvency and leverage of a business.

With horizontal analysis, we look at the. If the business has debt or liabilities equal to $30,000 and assets at $35,000, the debt-to-assets ratio would equal 0.86, which shows the amount of debt owed is very close to the number of assets.

Inhorizontal analysis, the analysts compare the financial information of one period with the previous years.

The bottom of the statement shows the cash balance of the business after all three types of activities are accounted for. In this free guide, we will break down the most important methods, types, and approaches to financial analysis. Financial analysis is important to keep track of the business's financial health. Compute the operating profit ratio of each company. Alpha Company Bravo Company Balance 12/31/15 Assets $165,000 Liabilities $117,000 Equity 140,000 155,000 Balance, External funding needs are computed as: A. total assets - (projected liabilities + projected net worth) B.

While some statements focus on assets and liabilities, others focus on the revenue generated by the business and the expenses incurred. {{courseNav.course.mDynamicIntFields.lessonCount}} lessons In this, we compare a line item with the same line item in another period (a year or quarter). There are various ways that help a business in conducting performance analysis. The vertical analysis method allows analysing financial information in a proportional manner, where every line item on a financial statement is recorded as a proportion of another item. To determine this, the business refers to the balance sheet for the current assets and current liabilities. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Financial Management Concepts In Layman Terms, You got {{SCORE_CORRECT}} out of {{SCORE_TOTAL}}, Objectives of Financial Statement Analysis, International Financial Reporting Standards(IFRS), Comparative Financial Statements Meaning, Importance, and Example, Other Methods of Financial Statement Analysis, Advantages and Application of Ratio Analysis, (). Financial statement ratios use two or more lines from a financial statement to perform mathematical calculations.

An organizations financial statements for different periods are called Comparative Financial Statements. - Definition & Tools, What Is a Purchase Order? Get unlimited access to over 84,000 lessons. In the Red. If you are in business, here is a brief overview of how cause and effect analysis helps you find viable business solutions.

Its direct impact on the companys financial statements displays all items as a percentage of a common base figure.

The financial statement analysis is a tool through which various components of profitability during a specific period. It is a statement that depicts the sources. Are you a business analyst involved in the documentation of business rules and creation of complex decision tables?

Each of these statements offers financial insight in different ways. Below is an example of the cash flow statement and its three main components.

Below is an example of the cash flow statement and its three main components.

All rights reserved. This article will discuss all the probable tools and techniques of financial statement analysis. The company's current assets, current liabilities, and sales have been reported as follows. flashcard set{{course.flashcardSetCoun > 1 ? It is also important to prove the business's worth to lenders and investors. It includes KPIs (Key Performance Indicators), benchmarking, etc. If youd like to keep learning with free CFI resources, we highly recommend these additional guides to improve your financial statement analysis: Get Certified for Financial Modeling (FMVA). It enables one to have a comparative view of multiple parameters for two or more periods at a glance.

Use the minus sig, Retour Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. Vertical analysis analyzes financial information in statements in order from top to bottom. | {{course.flashcardSetCount}}

Efficiency ratios show the business's inputs and outputs, while solvency ratios show a company's long-term debt and its ability to meet these obligations.

flashcard sets, {{courseNav.course.topics.length}} chapters | Ratio analysis shows how data relates to other data.

Guide to analyzing financial statements for financial analysts.

For example, the operating profit ratio is calculated by dividing profits by sales. Create your account. It is a systematic risk assessment process used by analysts looking to reduce the chances of faults by detecting problems and their possible repercussions in time for remediation. Employing the user journey mapping technique involves adopting a user-centric approach to product design, revealing opportunities to delight customers and identifying pain points that can be addressed thereby creating a product with an improved user experience. It summarizes the reasons behind the changes in the cash position of a business entity between the dates of two balance sheets. Businesses are able to grow or expand as financial statement analysis provides insight for investors and lenders. Trend Analysis may be undertaken in respect of two organizations for the same period or an organization for a different period. The cash flow statement, or statement of cash flows, shows how cash flows both into and out of the business. Debt Ratio = Total Liabilities / Total Assets. One of the reasons why I find it so powerful is because it provides a unique approach for aligning discussions relating to the user, their goals, the process that supports the accomplishment of their predefined goals; and the requirements that need to be addressed to solve business problems.

The income statement shows how much income was generated and the expenses that were incurred to run the business. By using a pyramid of ratios, we are able to demonstrate how you can determine the profitability, efficiency, and leverage drivers for any business. Business Process Model and Notation (BPMN) is a global standard for constructing process models, with more organizations using it and schools teaching it as a subject. Usually, each line item is calculated as a proportion of revenue or sales in the income statement. Comment on how these companies compare in regards to their liquidity. However, the benchmark or ideal ratios vary from industry to industry.

This is because a lesser proportion of its assets are financed by debt.

Compute the debt ratio of each company. Financial statements produce a summary of data from which important analysis and interpretation can be made.

Kwik-E-Mart has a higher solvency than Grocery Plus. For example, the debt-to-asset ratio, also referred to simply as the debt ratio, is easily determined by dividing the total debt or liabilities by total assets: Debt-to-Asset Ratio = Total Liabilities / Total Assets. Working Scholars Bringing Tuition-Free College to the Community, Total Liabilities & Shareholders' Equity $70,000, Portion of total liabilities that are current. There are two main types of analysis we will perform: vertical analysis and horizontal analysis. This business analyst blog contains practical insights into business analysis, software testing and business process management.

Liquidity ratios include the current ratio, cash coverage ratio, quick ratio, and liquidity index. The basic format shows how assets are further divided into current assets, those due within a year, and noncurrent assets, those not due for at least a year. Refer to DUPONT ANALYSIS for in-depth understanding. Failure Mode and Effects Analysis (FMEA) is a proactive technique that can be applied to the early detection of failures or defects in products and services.

Accounting Cycle Concept & Steps | What is Accounting Cycle? And, it also describes how-to guides in various components of Balance Sheet and Profit and Loss Accounts. It shows how the business can afford its expenses and pay off current liabilities with its assets. Investing activities include cash flow from investments and securities, while financing activities consist of the cash flow from dividends and stocks. The financial statement analysis definition refers to the process of analyzing data from a company's financial documents and statements. Financial Statement Analysis Purpose & Examples | What Is Financial Analysis? Now its time to look at a different way to evaluate the income statement. Leverage ratios show whether a business relies on debt to cover operational costs. Debt-to-asset ratios, or debt ratios, help to determine percentage of assets financed with loans. techniques of financial statement analysis, Collective Bargaining: Definition | Features | Scope | Functions, Evolution of Human Resource Management with 6 Concepts, History of Human Resource Management With Top 7 Stages, Ratio Analysis Objective, Benefits, Limitations, Types, Major 6 Tools and Techniques of Financial Statement Analysis, Top 10 Limitations of Financial Statement, Preparation of Financial Statement Trading Account, Profit and Loss Account, Balance Sheet, INTERNATIONAL FINANCIAL REPORTING STANDARDS Features, Objectives and Importance.

International Financial Statement Analysis, Static Budget Meaning, Importance, Benefits and More, Difference between Financial and Management Accounting, Difference between Hire Purchase vs. In our course on Analysisof Financial Statements, we explore all the above metrics and ratios in great detail.

Installment Purchase System, Capital Structure Theory Modigliani and Miller (MM) Approach, Four Sector Model Meaning, Assumptions, and More, Three Sector Model: Meaning, Assumptions, and Diagram, Two Sector Model Meaning, Assumptions, Diagram and Drawbacks.

There will be a 10% earnings distribution for 2013. | 13

A background in Finance is certainly useful to be able to conduct financial analysis though this is not a pre-requisite. I will be sharing business analyst tips, CBAP Certification tips, lessons learnt and insights into all the things I've learnt during my BA career. Solvency ratios show a company's long-term debt and determine its ability to meet these obligations. In the black indicates that the company is in the profitable stage, while in the red means the company is not profitable. We have covered the complete ratio analysis its significance, application, importance, and limitations, and all 32 RATIOS of ratio analysis that are structured and categorized into 6 important heads. Ratio Analysis is a quantitative analysis technique that establishes the relationship between two or a combination of more than two items of financial statements. - Definition & Profess, TExES Science of Teaching Reading (293): Practice & Study Guide, Curriculum & Assessment in Music Education, Planned Value vs. Earned Value in Project Management, Difference Between There, Their & They're, Dreams in Crime & Punishment: Symbolism & Significance, The Pequod: The Whaling Ship in Moby-Dick, Quiz & Worksheet - Features & Genres of Dance, Quiz & Worksheet - Death on the Nile Literary Elements, Flashcards - Real Estate Marketing Basics, Flashcards - Promotional Marketing in Real Estate, Common Core English & Reading Worksheets & Printables, Human Resource Management Syllabus Resource & Lesson Plans, DSST Principles of Statistics: Study Guide & Test Prep, TExMaT Master Mathematics Teacher 8-12 (089): Practice & Study Guide, MTTC Biology (017): Practice & Study Guide, Quiz & Worksheet - Factoring Polynomial Expressions, Quiz & Worksheet - The Monkey's Paw Synopsis, Quiz & Worksheet - Events of the Great Depression, Quiz & Worksheet - The Quota Rule in Apportionment, Quiz & Worksheet - Cons of Apportionment in Politics, The Plurality-with-Elimination Election Method, What To Do If Your School Doesn't Accept Study.com Credit, Finding Continuing Education Grants for Teachers, Tech and Engineering - Questions & Answers, Health and Medicine - Questions & Answers, Sales for 2013 are projected to be $60,000; the firm currently uses straight line depreciation. Apart from the above popular methods, there are many more (but less popular) methods that help a business make decisions. This resource is designed to be the best free guide to financial modeling! Below is selected financial data for the company: Pront, Swazi Inc acquired sixty percent of Alberton Inc on January 1 2008 for 800000 in cash This price included a control premium of $ 40,000. The purpose of the balance sheet is to ensure all assets and liabilities are balanced out. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, 4. Both are Balance Sheet, Income Statement, and Cash Flow Statement.

A background in Finance is certainly useful to be able to conduct financial analysis though this is not a pre-requisite. I will be sharing business analyst tips, CBAP Certification tips, lessons learnt and insights into all the things I've learnt during my BA career. Solvency ratios show a company's long-term debt and determine its ability to meet these obligations. In the black indicates that the company is in the profitable stage, while in the red means the company is not profitable. We have covered the complete ratio analysis its significance, application, importance, and limitations, and all 32 RATIOS of ratio analysis that are structured and categorized into 6 important heads. Ratio Analysis is a quantitative analysis technique that establishes the relationship between two or a combination of more than two items of financial statements. - Definition & Profess, TExES Science of Teaching Reading (293): Practice & Study Guide, Curriculum & Assessment in Music Education, Planned Value vs. Earned Value in Project Management, Difference Between There, Their & They're, Dreams in Crime & Punishment: Symbolism & Significance, The Pequod: The Whaling Ship in Moby-Dick, Quiz & Worksheet - Features & Genres of Dance, Quiz & Worksheet - Death on the Nile Literary Elements, Flashcards - Real Estate Marketing Basics, Flashcards - Promotional Marketing in Real Estate, Common Core English & Reading Worksheets & Printables, Human Resource Management Syllabus Resource & Lesson Plans, DSST Principles of Statistics: Study Guide & Test Prep, TExMaT Master Mathematics Teacher 8-12 (089): Practice & Study Guide, MTTC Biology (017): Practice & Study Guide, Quiz & Worksheet - Factoring Polynomial Expressions, Quiz & Worksheet - The Monkey's Paw Synopsis, Quiz & Worksheet - Events of the Great Depression, Quiz & Worksheet - The Quota Rule in Apportionment, Quiz & Worksheet - Cons of Apportionment in Politics, The Plurality-with-Elimination Election Method, What To Do If Your School Doesn't Accept Study.com Credit, Finding Continuing Education Grants for Teachers, Tech and Engineering - Questions & Answers, Health and Medicine - Questions & Answers, Sales for 2013 are projected to be $60,000; the firm currently uses straight line depreciation. Apart from the above popular methods, there are many more (but less popular) methods that help a business make decisions. This resource is designed to be the best free guide to financial modeling! Below is selected financial data for the company: Pront, Swazi Inc acquired sixty percent of Alberton Inc on January 1 2008 for 800000 in cash This price included a control premium of $ 40,000. The purpose of the balance sheet is to ensure all assets and liabilities are balanced out. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, 4. Both are Balance Sheet, Income Statement, and Cash Flow Statement.

These include the balance sheet, the cash flow statements, and the income statement. What is Object-Oriented Analysis & Design? Ratios have been generalised into four categories namely: liquidity ratios, activity ratios, leverage ratios, and profitability ratios.

The income statement is a financial document that displays both the revenue generated by the company and the costs incurred. Following are the most popular methods of financial statement analysis: Ratio analysis is amongst the most popular methods of financial statement analysis. It may be defined as a mathematical technique that uses historical data to forecast future outcomes.

Liquidity ratios are used to show how liquid a business is, while profitability ratios show whether a business can generate a profit. A common type of efficiency ratio is the turnover ratio, which determines the amount of output per input. You obtain the following financial information on each of these companies.

Current Ratio = Current assets / Current liabilities. User story maps are an interesting and collaborative way of eliciting user requirements. Financial statement analysis (FSA) means studying the financial statements of a company to get meaningful information for decision making. After calculating ratios, one can compare them with the past years to identify any unusual happenings. Horizontal analysis is the process of analyzing data by comparing it to previous periods. The YoY change in revenue is equal to $55,749 / $53,494 minus one, which equals 4.2%. After that, this method helps to define the relationship between sales and variable costs, and the fixed cost. Rates of Return and Profitability Analysis, How to be a World-class Financial Analyst, Earnings Before Tax (EBT) as a percent of revenue, Profitability, efficiency and leverage ratios. Already registered? Financial statement ratios use two or more lines from a financial statement to perform mathematical calculations.

Banks, auditors, analyst firms, credit rating agencies, lenders, etc., use these methods to understand the health of a company. Pronto uses a LIFO cost-flow assumption for inventories. Free cash flow is the amount of cash left over after deducting operating expenses and all dividends owed to shareholders from the income generated from the business's operations.

This is the most advanced section of our financial analysis course, and we recommend that you watch a demonstration of how professionals perform this analysis. In trend analysis, users assess statements for incremental change patterns.

This means that it is less likely to run into issues paying off its current debt seeing that it has more current assets for every dollar of current debt than Grocery Plus. Linking the 3 statementstogether in Excel is the building block of financial modeling.

Applications of funds for a specific period.

Complete the worksheet.

It tells wherefrom the business is getting the funds and where it is spending them. That financial performance, like its efficiency, liquidity, profitability, and solvency, is helpful for the management in making certain decisions.

He is passionate about keeping and making things simple and easy. All other trademarks and copyrights are the property of their respective owners.

Also, one can compare the ratios with the set standards or the ideal ratio. The main liquidity ratios for a business are: The main operating efficiency ratios are: Using the above financial ratios, we can determine how efficiently a company is generating revenue and how quickly its selling inventory. List of Excel Shortcuts Analysis using the comparative financial statement method is similar to the horizontal andvertical analysis. Enrolling in a course lets you earn progress by passing quizzes and exams. This method of financial analysis is similar to horizontal analysis. Horizontal analysis analyzes data by comparing it to previous periods. Through the fund flow statement, research concerning the changes in the financial position of an organization from the beginning of a period to its end is undertaken. If we have no funds flow statement, we cannot use the tools and techniques of financial statement analysis. Ratios are calculated in different ways to show give different insights. For instance, the current ratio of 2:1 is excellent. Such a technique helps a business to find a break-even point, margin of safety, etc. Lets move on to thebalance sheet. Comparative statement is important in the sense of financial tools and techniques. This analysis uses statements commonly used in business, such as the balance sheet, the cash flow statement, and the income statement. To learn how to perform this analysis step-by-step, please check out ourFinancialAnalysis Fundamentals Course. The course includes a hands-on case study andExcel templatesthat can be used to calculate individual ratios and a pyramid of ratios from any set of financial statements. Corporate Finance Topics & Role | What Is Corporate Finance? studynotesexpert@gmail.com

Under trend analysis, the earliest year becomes the base year.

If a business can show its financial health to potential investors, it may be successful in gaining investors to grow the business. Financial analysis may be defined as the process of highlighting the financial strengths and flaws of a business by studying both its balance sheet and income statement elements. These statements include the balance sheet, the cash flow statement, and the income statement.

For instance, if the cost of goods sold (COGS) rises much more than the increase in sales or gross profit rises but net profit drops. Naturally, this implies that each line item detailed on the income statement is quantified as a proportion of gross sales, whereas each line item detailed on a balance sheet is quantified as a proportion of total assets. While each of these statements may follow a slightly different format and may include more detailed information, the basic formats of these statements are as follows: The balance sheet is divided into two sections, which are the assets and liabilities, along with shareholders' equity. As a member, you'll also get unlimited access to over 84,000

Discover how to use financial analysis ratios, and examine financial statement analysis examples.

Steven completed a Graduate Degree is Chartered Accountancy at Concordia University. No new equipment purchases are planned for 2013.

For example, the debt-to-equity ratio is calculated by dividing the total debt by the total equity: If the business had $80,000 in debt and $50,000 in equity, the ratio would equal 1.6. Financial statement analysis is also beneficial in complying with regulations and corporate governance.

These include operating activities, investing activities, and financing activities. There are many benefits for a business when using financial statement analysis.

It makes it easy to compare a line item with the previous years. Sign up with your email address to receive news and updates. The current ratio is calculated by dividing current assets by current liabilities. Learn what financial statement analysis is and why it matters. Liquidity ratios are used to show how liquid a business is, meaning whether they are able to quickly turn its assets into cash. We will take several items on the income statement and compare them to accounts on the balance sheet. Lets take a quick test on the topic you have read here. 14 chapters | In the absence of the above methods of financial statement analysis, it could be challenging to carry out a financial review.

There are three main methods that are used in financial statement analysis. Read more about it at In the Black Vs. The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency. Changes in the working capital method help to study any rise or drop in the working capital. This method also helps to study the sources and uses of the funds for a given period. These methods do not precisely fall under financial statement analysis, yet they assist analysts, management, and other stakeholders in arriving at a decision. These include vertical analysis, horizontal analysis, and ratios.

+91 8168659774, on Major 6 Tools and Techniques of Financial Statement Analysis, Tools and Techniques of Financial Statement Analysis. To unlock this lesson you must be a Study.com Member. About : Founder & Managed By -Netpreneur Ravinder Ahlawat, Address : Jind, Haryana India

She is a small business contributing writer for a finance website, with prior management experience at a Fortune 100 company and experience as a web producer at a news station. External stakeholders also carry out financial statement analysis for several purposes, apart from the management.

After a ratio is calculated, it can be used to compare a similar ratio calculated for a previous period, or a ratio founded on an average of a particular industry in order to establish whether the companys performance is in harmony with set expectations.

In this method also, we compare and review the financial statements for three or more years.

Cost Volume Profit analysis or CVP analysis helps establish a relationship between sales, cost, and profit. You are an investor debating on whether to invest in either two companies: Kwik-E-Mart or Grocery Plus. Kristen has her Bachelor of Arts in Communication (cum laude) with certificates in finance, marketing, and graphic design.

Some popular ratios are the current ratio, PE ratio, debt ratio, and more. Or, they can also compare it with the industry average or with the competitors. Save my name, email, and website in this browser for the next time I comment.

Try refreshing the page, or contact customer support. Quiz on Methods of Financial Statement Analysis. Once the business has these documents and ensures they are accurate, one of the previously mentioned methods can be chosen to conduct the financial analysis.

It is usually used to evaluate various aspects of a companys operating and financial performance. Its important to understand how different ratios can be used to properly assess the operation of an organization from a cash management standpoint. The objective is to find any significant change in any line item.

Projected total assets - (actual liabilities + net worth) C. Projected current assets - (proj, The adjusted trial balance columns of the worksheet for Savaglia Company are as follows. For this analysis, we segregate costs into variable and fixed costs. The cash flow statement separates the financial data into three categories: operating activities, investing activities, and financing activities.

External stakeholders, including analysts, financial institutions, creditors, lenders, etc., do FSA to understand the companys health. There are different types of ratios that help management and analysts to dig out meaningful information. These ratios show whether a company can afford its expenses. Conducting a review of how a business is performing can prove daunting, since it requires an organised collection and evaluation of financial information. Operating activities include the cash flow from the costs and income associated with the operations of the business.

But, DuPont analysis split this formula into a product of net profit margin, asset turnover, and financial leverage. copyright 2003-2022 Study.com. In order to answer these questions, and much more, we will dive into the income statement to get started.

These methods are: This method helps to study the inflow and outflow of cash and bank balances. These figures could either be absolute, absolute increase or decrease from the past year, in terms of percentage or comparison as ratios. The three main methods used in financial statement analysis include vertical analysis, horizontal analysis, and ratio analysis. Financial Statement Analysis in Accounting, {{courseNav.course.mDynamicIntFields.lessonCount}}, Standards for Comparison in Financial Statement Analysis, All Teacher Certification Test Prep Courses, Kristen Rogers, Tammy Galloway, Steven Scalia.

Financial analysis can be conducted by referencing the income statement and cash flow statement for information about a company's finances. A change in financial statements can indicate that there are either increased income or decreased expenses.

There is also the option of outsourcing this function to a specialist, if this is not an area you have interest in.

Solvency ratios include the time's interest earned ratio, the debt-to-service ratio, and the debt-to-asset ratio. This entails reviewing financial statements of three or more periods, an extension of horizontal analysis. Adjusting Accounts and Preparing Financial Statements, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis: Definition, Purpose, Elements & Examples, Effective Communication in the Workplace: Help and Review, DSST Business Ethics and Society: Study Guide & Test Prep, Introduction to Management: Help and Review, Intro to PowerPoint: Essential Training & Tutorials, Public Speaking Syllabus Resource & Lesson Plans, FTCE Marketing 6-12 (057): Test Practice & Study Guide, Computing for Teachers: Professional Development, UExcel Principles of Management: Study Guide & Test Prep. The main purpose of financial analysis is to track the progress and performance of the business and evaluate its financial health. Guest post by Lucas Cappel. Working Capital is the difference between the current assets and the current liabilities.

This means that every dollar of sales will generate more profit for Kwik-E-Mart than for Grocery Plus. Log in or sign up to add this lesson to a Custom Course.

Comment on how these companies compare in regards to their profitability. An analyst can also use ratios to identify trends (if any) in the financial numbers. The right side also shows liabilities further categorized into current and noncurrent liabilities, as well as the shareholder's equity, which is the money owed to the owners and investors.

After analysts calculate a ratio (or ratios), they can compare it with the same ratio of previous years. Requirements Discovery ListHow to Start Your BA CareerBA Template ToolkitBA Email Toolkit. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Intuitively, this is usually the first thing we think about with a business we often ask questions such as, How much revenue does it have? Is it profitable? and What are the margins like?.

The earliest year in the set data represents the base year. Your email address will not be published. These are the all major tools and techniques of financial statement analysis.

3. Moreover, fund flow analysis also assists in highlighting changes (if any) in a companys financial structure.

Kwik-E-Mart has a higher liquidity than Grocery Plus. lessons in math, English, science, history, and more. succeed.

SAVAGLIA COMPANY Worksheet (partial) Account Titles Adjusted Trial Balance Income St, Pronto, Inc. is a major producer of printing equipment. 2. 1.

A concept model provides a great way of documenting definitions and communicating precise meanings of terms to stakeholders.

Using the financial ratios derived from the balance sheet and comparing them historically versus industry averages or competitors will help you assess the solvency and leverage of a business.

With horizontal analysis, we look at the. If the business has debt or liabilities equal to $30,000 and assets at $35,000, the debt-to-assets ratio would equal 0.86, which shows the amount of debt owed is very close to the number of assets.

Inhorizontal analysis, the analysts compare the financial information of one period with the previous years.

The bottom of the statement shows the cash balance of the business after all three types of activities are accounted for. In this free guide, we will break down the most important methods, types, and approaches to financial analysis. Financial analysis is important to keep track of the business's financial health. Compute the operating profit ratio of each company. Alpha Company Bravo Company Balance 12/31/15 Assets $165,000 Liabilities $117,000 Equity 140,000 155,000 Balance, External funding needs are computed as: A. total assets - (projected liabilities + projected net worth) B.

While some statements focus on assets and liabilities, others focus on the revenue generated by the business and the expenses incurred. {{courseNav.course.mDynamicIntFields.lessonCount}} lessons In this, we compare a line item with the same line item in another period (a year or quarter). There are various ways that help a business in conducting performance analysis. The vertical analysis method allows analysing financial information in a proportional manner, where every line item on a financial statement is recorded as a proportion of another item. To determine this, the business refers to the balance sheet for the current assets and current liabilities. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Financial Management Concepts In Layman Terms, You got {{SCORE_CORRECT}} out of {{SCORE_TOTAL}}, Objectives of Financial Statement Analysis, International Financial Reporting Standards(IFRS), Comparative Financial Statements Meaning, Importance, and Example, Other Methods of Financial Statement Analysis, Advantages and Application of Ratio Analysis, (). Financial statement ratios use two or more lines from a financial statement to perform mathematical calculations.

An organizations financial statements for different periods are called Comparative Financial Statements. - Definition & Tools, What Is a Purchase Order? Get unlimited access to over 84,000 lessons. In the Red. If you are in business, here is a brief overview of how cause and effect analysis helps you find viable business solutions.

Its direct impact on the companys financial statements displays all items as a percentage of a common base figure.

The financial statement analysis is a tool through which various components of profitability during a specific period. It is a statement that depicts the sources. Are you a business analyst involved in the documentation of business rules and creation of complex decision tables?

Each of these statements offers financial insight in different ways.

Below is an example of the cash flow statement and its three main components.

Below is an example of the cash flow statement and its three main components. All rights reserved. This article will discuss all the probable tools and techniques of financial statement analysis. The company's current assets, current liabilities, and sales have been reported as follows. flashcard set{{course.flashcardSetCoun > 1 ? It is also important to prove the business's worth to lenders and investors. It includes KPIs (Key Performance Indicators), benchmarking, etc. If youd like to keep learning with free CFI resources, we highly recommend these additional guides to improve your financial statement analysis: Get Certified for Financial Modeling (FMVA). It enables one to have a comparative view of multiple parameters for two or more periods at a glance.

Use the minus sig, Retour Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. Vertical analysis analyzes financial information in statements in order from top to bottom. | {{course.flashcardSetCount}}

Efficiency ratios show the business's inputs and outputs, while solvency ratios show a company's long-term debt and its ability to meet these obligations.

flashcard sets, {{courseNav.course.topics.length}} chapters | Ratio analysis shows how data relates to other data.

Guide to analyzing financial statements for financial analysts.

For example, the operating profit ratio is calculated by dividing profits by sales. Create your account. It is a systematic risk assessment process used by analysts looking to reduce the chances of faults by detecting problems and their possible repercussions in time for remediation. Employing the user journey mapping technique involves adopting a user-centric approach to product design, revealing opportunities to delight customers and identifying pain points that can be addressed thereby creating a product with an improved user experience. It summarizes the reasons behind the changes in the cash position of a business entity between the dates of two balance sheets. Businesses are able to grow or expand as financial statement analysis provides insight for investors and lenders. Trend Analysis may be undertaken in respect of two organizations for the same period or an organization for a different period. The cash flow statement, or statement of cash flows, shows how cash flows both into and out of the business. Debt Ratio = Total Liabilities / Total Assets. One of the reasons why I find it so powerful is because it provides a unique approach for aligning discussions relating to the user, their goals, the process that supports the accomplishment of their predefined goals; and the requirements that need to be addressed to solve business problems.

The income statement shows how much income was generated and the expenses that were incurred to run the business. By using a pyramid of ratios, we are able to demonstrate how you can determine the profitability, efficiency, and leverage drivers for any business. Business Process Model and Notation (BPMN) is a global standard for constructing process models, with more organizations using it and schools teaching it as a subject. Usually, each line item is calculated as a proportion of revenue or sales in the income statement. Comment on how these companies compare in regards to their liquidity. However, the benchmark or ideal ratios vary from industry to industry.

This is because a lesser proportion of its assets are financed by debt.

Compute the debt ratio of each company. Financial statements produce a summary of data from which important analysis and interpretation can be made.

Kwik-E-Mart has a higher solvency than Grocery Plus. For example, the debt-to-asset ratio, also referred to simply as the debt ratio, is easily determined by dividing the total debt or liabilities by total assets: Debt-to-Asset Ratio = Total Liabilities / Total Assets. Working Scholars Bringing Tuition-Free College to the Community, Total Liabilities & Shareholders' Equity $70,000, Portion of total liabilities that are current. There are two main types of analysis we will perform: vertical analysis and horizontal analysis. This business analyst blog contains practical insights into business analysis, software testing and business process management.

Liquidity ratios include the current ratio, cash coverage ratio, quick ratio, and liquidity index. The basic format shows how assets are further divided into current assets, those due within a year, and noncurrent assets, those not due for at least a year. Refer to DUPONT ANALYSIS for in-depth understanding. Failure Mode and Effects Analysis (FMEA) is a proactive technique that can be applied to the early detection of failures or defects in products and services.

Accounting Cycle Concept & Steps | What is Accounting Cycle? And, it also describes how-to guides in various components of Balance Sheet and Profit and Loss Accounts. It shows how the business can afford its expenses and pay off current liabilities with its assets. Investing activities include cash flow from investments and securities, while financing activities consist of the cash flow from dividends and stocks. The financial statement analysis definition refers to the process of analyzing data from a company's financial documents and statements. Financial Statement Analysis Purpose & Examples | What Is Financial Analysis? Now its time to look at a different way to evaluate the income statement. Leverage ratios show whether a business relies on debt to cover operational costs. Debt-to-asset ratios, or debt ratios, help to determine percentage of assets financed with loans. techniques of financial statement analysis, Collective Bargaining: Definition | Features | Scope | Functions, Evolution of Human Resource Management with 6 Concepts, History of Human Resource Management With Top 7 Stages, Ratio Analysis Objective, Benefits, Limitations, Types, Major 6 Tools and Techniques of Financial Statement Analysis, Top 10 Limitations of Financial Statement, Preparation of Financial Statement Trading Account, Profit and Loss Account, Balance Sheet, INTERNATIONAL FINANCIAL REPORTING STANDARDS Features, Objectives and Importance.

International Financial Statement Analysis, Static Budget Meaning, Importance, Benefits and More, Difference between Financial and Management Accounting, Difference between Hire Purchase vs. In our course on Analysisof Financial Statements, we explore all the above metrics and ratios in great detail.

Installment Purchase System, Capital Structure Theory Modigliani and Miller (MM) Approach, Four Sector Model Meaning, Assumptions, and More, Three Sector Model: Meaning, Assumptions, and Diagram, Two Sector Model Meaning, Assumptions, Diagram and Drawbacks.

There will be a 10% earnings distribution for 2013. | 13

A background in Finance is certainly useful to be able to conduct financial analysis though this is not a pre-requisite. I will be sharing business analyst tips, CBAP Certification tips, lessons learnt and insights into all the things I've learnt during my BA career. Solvency ratios show a company's long-term debt and determine its ability to meet these obligations. In the black indicates that the company is in the profitable stage, while in the red means the company is not profitable. We have covered the complete ratio analysis its significance, application, importance, and limitations, and all 32 RATIOS of ratio analysis that are structured and categorized into 6 important heads. Ratio Analysis is a quantitative analysis technique that establishes the relationship between two or a combination of more than two items of financial statements. - Definition & Profess, TExES Science of Teaching Reading (293): Practice & Study Guide, Curriculum & Assessment in Music Education, Planned Value vs. Earned Value in Project Management, Difference Between There, Their & They're, Dreams in Crime & Punishment: Symbolism & Significance, The Pequod: The Whaling Ship in Moby-Dick, Quiz & Worksheet - Features & Genres of Dance, Quiz & Worksheet - Death on the Nile Literary Elements, Flashcards - Real Estate Marketing Basics, Flashcards - Promotional Marketing in Real Estate, Common Core English & Reading Worksheets & Printables, Human Resource Management Syllabus Resource & Lesson Plans, DSST Principles of Statistics: Study Guide & Test Prep, TExMaT Master Mathematics Teacher 8-12 (089): Practice & Study Guide, MTTC Biology (017): Practice & Study Guide, Quiz & Worksheet - Factoring Polynomial Expressions, Quiz & Worksheet - The Monkey's Paw Synopsis, Quiz & Worksheet - Events of the Great Depression, Quiz & Worksheet - The Quota Rule in Apportionment, Quiz & Worksheet - Cons of Apportionment in Politics, The Plurality-with-Elimination Election Method, What To Do If Your School Doesn't Accept Study.com Credit, Finding Continuing Education Grants for Teachers, Tech and Engineering - Questions & Answers, Health and Medicine - Questions & Answers, Sales for 2013 are projected to be $60,000; the firm currently uses straight line depreciation. Apart from the above popular methods, there are many more (but less popular) methods that help a business make decisions. This resource is designed to be the best free guide to financial modeling! Below is selected financial data for the company: Pront, Swazi Inc acquired sixty percent of Alberton Inc on January 1 2008 for 800000 in cash This price included a control premium of $ 40,000. The purpose of the balance sheet is to ensure all assets and liabilities are balanced out. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, 4. Both are Balance Sheet, Income Statement, and Cash Flow Statement.

A background in Finance is certainly useful to be able to conduct financial analysis though this is not a pre-requisite. I will be sharing business analyst tips, CBAP Certification tips, lessons learnt and insights into all the things I've learnt during my BA career. Solvency ratios show a company's long-term debt and determine its ability to meet these obligations. In the black indicates that the company is in the profitable stage, while in the red means the company is not profitable. We have covered the complete ratio analysis its significance, application, importance, and limitations, and all 32 RATIOS of ratio analysis that are structured and categorized into 6 important heads. Ratio Analysis is a quantitative analysis technique that establishes the relationship between two or a combination of more than two items of financial statements. - Definition & Profess, TExES Science of Teaching Reading (293): Practice & Study Guide, Curriculum & Assessment in Music Education, Planned Value vs. Earned Value in Project Management, Difference Between There, Their & They're, Dreams in Crime & Punishment: Symbolism & Significance, The Pequod: The Whaling Ship in Moby-Dick, Quiz & Worksheet - Features & Genres of Dance, Quiz & Worksheet - Death on the Nile Literary Elements, Flashcards - Real Estate Marketing Basics, Flashcards - Promotional Marketing in Real Estate, Common Core English & Reading Worksheets & Printables, Human Resource Management Syllabus Resource & Lesson Plans, DSST Principles of Statistics: Study Guide & Test Prep, TExMaT Master Mathematics Teacher 8-12 (089): Practice & Study Guide, MTTC Biology (017): Practice & Study Guide, Quiz & Worksheet - Factoring Polynomial Expressions, Quiz & Worksheet - The Monkey's Paw Synopsis, Quiz & Worksheet - Events of the Great Depression, Quiz & Worksheet - The Quota Rule in Apportionment, Quiz & Worksheet - Cons of Apportionment in Politics, The Plurality-with-Elimination Election Method, What To Do If Your School Doesn't Accept Study.com Credit, Finding Continuing Education Grants for Teachers, Tech and Engineering - Questions & Answers, Health and Medicine - Questions & Answers, Sales for 2013 are projected to be $60,000; the firm currently uses straight line depreciation. Apart from the above popular methods, there are many more (but less popular) methods that help a business make decisions. This resource is designed to be the best free guide to financial modeling! Below is selected financial data for the company: Pront, Swazi Inc acquired sixty percent of Alberton Inc on January 1 2008 for 800000 in cash This price included a control premium of $ 40,000. The purpose of the balance sheet is to ensure all assets and liabilities are balanced out. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, 4. Both are Balance Sheet, Income Statement, and Cash Flow Statement. These include the balance sheet, the cash flow statements, and the income statement. What is Object-Oriented Analysis & Design? Ratios have been generalised into four categories namely: liquidity ratios, activity ratios, leverage ratios, and profitability ratios.

The income statement is a financial document that displays both the revenue generated by the company and the costs incurred. Following are the most popular methods of financial statement analysis: Ratio analysis is amongst the most popular methods of financial statement analysis. It may be defined as a mathematical technique that uses historical data to forecast future outcomes.

Liquidity ratios are used to show how liquid a business is, while profitability ratios show whether a business can generate a profit. A common type of efficiency ratio is the turnover ratio, which determines the amount of output per input. You obtain the following financial information on each of these companies.

Current Ratio = Current assets / Current liabilities. User story maps are an interesting and collaborative way of eliciting user requirements. Financial statement analysis (FSA) means studying the financial statements of a company to get meaningful information for decision making. After calculating ratios, one can compare them with the past years to identify any unusual happenings. Horizontal analysis is the process of analyzing data by comparing it to previous periods. The YoY change in revenue is equal to $55,749 / $53,494 minus one, which equals 4.2%. After that, this method helps to define the relationship between sales and variable costs, and the fixed cost. Rates of Return and Profitability Analysis, How to be a World-class Financial Analyst, Earnings Before Tax (EBT) as a percent of revenue, Profitability, efficiency and leverage ratios. Already registered? Financial statement ratios use two or more lines from a financial statement to perform mathematical calculations.

Banks, auditors, analyst firms, credit rating agencies, lenders, etc., use these methods to understand the health of a company. Pronto uses a LIFO cost-flow assumption for inventories. Free cash flow is the amount of cash left over after deducting operating expenses and all dividends owed to shareholders from the income generated from the business's operations.

This is the most advanced section of our financial analysis course, and we recommend that you watch a demonstration of how professionals perform this analysis. In trend analysis, users assess statements for incremental change patterns.

This means that it is less likely to run into issues paying off its current debt seeing that it has more current assets for every dollar of current debt than Grocery Plus. Linking the 3 statementstogether in Excel is the building block of financial modeling.

Applications of funds for a specific period.

Complete the worksheet.

It tells wherefrom the business is getting the funds and where it is spending them. That financial performance, like its efficiency, liquidity, profitability, and solvency, is helpful for the management in making certain decisions.

He is passionate about keeping and making things simple and easy. All other trademarks and copyrights are the property of their respective owners.

Also, one can compare the ratios with the set standards or the ideal ratio. The main liquidity ratios for a business are: The main operating efficiency ratios are: Using the above financial ratios, we can determine how efficiently a company is generating revenue and how quickly its selling inventory. List of Excel Shortcuts Analysis using the comparative financial statement method is similar to the horizontal andvertical analysis. Enrolling in a course lets you earn progress by passing quizzes and exams. This method of financial analysis is similar to horizontal analysis. Horizontal analysis analyzes data by comparing it to previous periods. Through the fund flow statement, research concerning the changes in the financial position of an organization from the beginning of a period to its end is undertaken. If we have no funds flow statement, we cannot use the tools and techniques of financial statement analysis. Ratios are calculated in different ways to show give different insights. For instance, the current ratio of 2:1 is excellent. Such a technique helps a business to find a break-even point, margin of safety, etc. Lets move on to thebalance sheet. Comparative statement is important in the sense of financial tools and techniques. This analysis uses statements commonly used in business, such as the balance sheet, the cash flow statement, and the income statement. To learn how to perform this analysis step-by-step, please check out ourFinancialAnalysis Fundamentals Course. The course includes a hands-on case study andExcel templatesthat can be used to calculate individual ratios and a pyramid of ratios from any set of financial statements. Corporate Finance Topics & Role | What Is Corporate Finance? studynotesexpert@gmail.com

Under trend analysis, the earliest year becomes the base year.

If a business can show its financial health to potential investors, it may be successful in gaining investors to grow the business. Financial analysis may be defined as the process of highlighting the financial strengths and flaws of a business by studying both its balance sheet and income statement elements. These statements include the balance sheet, the cash flow statement, and the income statement.

For instance, if the cost of goods sold (COGS) rises much more than the increase in sales or gross profit rises but net profit drops. Naturally, this implies that each line item detailed on the income statement is quantified as a proportion of gross sales, whereas each line item detailed on a balance sheet is quantified as a proportion of total assets. While each of these statements may follow a slightly different format and may include more detailed information, the basic formats of these statements are as follows: The balance sheet is divided into two sections, which are the assets and liabilities, along with shareholders' equity. As a member, you'll also get unlimited access to over 84,000

Discover how to use financial analysis ratios, and examine financial statement analysis examples.

Steven completed a Graduate Degree is Chartered Accountancy at Concordia University. No new equipment purchases are planned for 2013.

For example, the debt-to-equity ratio is calculated by dividing the total debt by the total equity: If the business had $80,000 in debt and $50,000 in equity, the ratio would equal 1.6. Financial statement analysis is also beneficial in complying with regulations and corporate governance.

These include operating activities, investing activities, and financing activities. There are many benefits for a business when using financial statement analysis.

It makes it easy to compare a line item with the previous years. Sign up with your email address to receive news and updates. The current ratio is calculated by dividing current assets by current liabilities. Learn what financial statement analysis is and why it matters. Liquidity ratios are used to show how liquid a business is, meaning whether they are able to quickly turn its assets into cash. We will take several items on the income statement and compare them to accounts on the balance sheet. Lets take a quick test on the topic you have read here. 14 chapters | In the absence of the above methods of financial statement analysis, it could be challenging to carry out a financial review.

There are three main methods that are used in financial statement analysis. Read more about it at In the Black Vs. The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency. Changes in the working capital method help to study any rise or drop in the working capital. This method also helps to study the sources and uses of the funds for a given period. These methods do not precisely fall under financial statement analysis, yet they assist analysts, management, and other stakeholders in arriving at a decision. These include vertical analysis, horizontal analysis, and ratios.

+91 8168659774, on Major 6 Tools and Techniques of Financial Statement Analysis, Tools and Techniques of Financial Statement Analysis. To unlock this lesson you must be a Study.com Member. About : Founder & Managed By -Netpreneur Ravinder Ahlawat, Address : Jind, Haryana India

She is a small business contributing writer for a finance website, with prior management experience at a Fortune 100 company and experience as a web producer at a news station. External stakeholders also carry out financial statement analysis for several purposes, apart from the management.

After a ratio is calculated, it can be used to compare a similar ratio calculated for a previous period, or a ratio founded on an average of a particular industry in order to establish whether the companys performance is in harmony with set expectations.

In this method also, we compare and review the financial statements for three or more years.

Cost Volume Profit analysis or CVP analysis helps establish a relationship between sales, cost, and profit. You are an investor debating on whether to invest in either two companies: Kwik-E-Mart or Grocery Plus. Kristen has her Bachelor of Arts in Communication (cum laude) with certificates in finance, marketing, and graphic design.

Some popular ratios are the current ratio, PE ratio, debt ratio, and more. Or, they can also compare it with the industry average or with the competitors. Save my name, email, and website in this browser for the next time I comment.

Try refreshing the page, or contact customer support. Quiz on Methods of Financial Statement Analysis. Once the business has these documents and ensures they are accurate, one of the previously mentioned methods can be chosen to conduct the financial analysis.

It is usually used to evaluate various aspects of a companys operating and financial performance. Its important to understand how different ratios can be used to properly assess the operation of an organization from a cash management standpoint. The objective is to find any significant change in any line item.

Projected total assets - (actual liabilities + net worth) C. Projected current assets - (proj, The adjusted trial balance columns of the worksheet for Savaglia Company are as follows. For this analysis, we segregate costs into variable and fixed costs. The cash flow statement separates the financial data into three categories: operating activities, investing activities, and financing activities.

External stakeholders, including analysts, financial institutions, creditors, lenders, etc., do FSA to understand the companys health. There are different types of ratios that help management and analysts to dig out meaningful information. These ratios show whether a company can afford its expenses. Conducting a review of how a business is performing can prove daunting, since it requires an organised collection and evaluation of financial information. Operating activities include the cash flow from the costs and income associated with the operations of the business.

But, DuPont analysis split this formula into a product of net profit margin, asset turnover, and financial leverage. copyright 2003-2022 Study.com. In order to answer these questions, and much more, we will dive into the income statement to get started.

These methods are: This method helps to study the inflow and outflow of cash and bank balances. These figures could either be absolute, absolute increase or decrease from the past year, in terms of percentage or comparison as ratios. The three main methods used in financial statement analysis include vertical analysis, horizontal analysis, and ratio analysis. Financial Statement Analysis in Accounting, {{courseNav.course.mDynamicIntFields.lessonCount}}, Standards for Comparison in Financial Statement Analysis, All Teacher Certification Test Prep Courses, Kristen Rogers, Tammy Galloway, Steven Scalia.

Financial analysis can be conducted by referencing the income statement and cash flow statement for information about a company's finances. A change in financial statements can indicate that there are either increased income or decreased expenses.

There is also the option of outsourcing this function to a specialist, if this is not an area you have interest in.