Extra days and hours amount to overtime pay. Having represented hundreds of successful crowdfunded startups, I'm one of the most well known attorneys for startups seeking CF funds. How Does 401(k) Matching Work for Employers? If you dont know these rights, clients may pay you less (or not at all), make you work longer hours than you should, and require duties you never intended to do. However, the employer-independent contractor relationship must follow specific federal rules and may be subject to further state regulations. Not only is their service more convenient and time-efficient than visiting brick and mortar offices, but its more affordable tooand Ive been universally impressed by the quality of talent provided.  This independent contractor then employs subcontractors who are paid and controlled by the contractor but who still performs labor for the employer. Advertising in classified ads as a freelancer also helps. The higher-tier subcontractors can ask to be added to the lower-tier subcontractor's policy as additional insured. The record will outline all pertinent features of the contract. Clients dont make tax deductions and pay the independent contractor like they would any other invoice. Clients Rate Lawyers on our Platform 4.9/5 Stars. What are the differences between an independent contractor and an employee? Understanding your legal rights as an independent contractor or a business hiring an independent contractor will keep legally concerns in check.

This independent contractor then employs subcontractors who are paid and controlled by the contractor but who still performs labor for the employer. Advertising in classified ads as a freelancer also helps. The higher-tier subcontractors can ask to be added to the lower-tier subcontractor's policy as additional insured. The record will outline all pertinent features of the contract. Clients dont make tax deductions and pay the independent contractor like they would any other invoice. Clients Rate Lawyers on our Platform 4.9/5 Stars. What are the differences between an independent contractor and an employee? Understanding your legal rights as an independent contractor or a business hiring an independent contractor will keep legally concerns in check.

Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of time. Make sure your contract establishes an independent contractor-client project-oriented relationship. Employees are also more likely to have open-ended job descriptions within a specific role. Independent contractors can perform various functions involving specialized tasks beyond the scope of the clients ordinary course of business. 3 min read.

Local and state regulations are becoming increasingly strict in the gig economy. Some IT professionals are independent contractors. Contractors usually hire subcontractors as part of a crew of workers who provide extra help and special skills.  Primarily my clients are start-up companies for which I perform various types of legal work, including negotiating and drafting settlement, preparing operating agreements and partnership agreements, assisting in moving companies to incorporate in new states and setting up companies to become registered in a state, assisting with employment matters, drafting non-disclosure agreements, assisting with private placement offerings, and researching issues on intellectual property, local regulations, privacy laws, corporate governance, and many other facets of the law, as the need arises. A business person without a legally binding contract with a client becomes exposed to abuse. Federal and state laws establish the normal workweek for employees (typically Monday through Friday) and legal holidays where no one works. Usually, each subcontractor is paid a portion of what the contractor receives for the labor. It boils down to how the IRS perceives the behavior and the relationship between the client and the contractor. The pay that the contractor will receive for his/her labor. Coverage is dependent on actual facts and circumstances giving rise to a claim. Subcontractor vs Independent contractor is a difference in employment relationship with a laborer. They supply their own work tools and must submit invoices for payment. Normally they get paid by a check which includes deductions for the employees contributions to social security and Medicare. A contractor is employed to build a home for someone. Exert your expertise as an independent contractor using your knowledge to perform duties. Here is an article The essence of being in business for yourself puts you in control. They may also owe misclassified workers benefits and backpay.

Primarily my clients are start-up companies for which I perform various types of legal work, including negotiating and drafting settlement, preparing operating agreements and partnership agreements, assisting in moving companies to incorporate in new states and setting up companies to become registered in a state, assisting with employment matters, drafting non-disclosure agreements, assisting with private placement offerings, and researching issues on intellectual property, local regulations, privacy laws, corporate governance, and many other facets of the law, as the need arises. A business person without a legally binding contract with a client becomes exposed to abuse. Federal and state laws establish the normal workweek for employees (typically Monday through Friday) and legal holidays where no one works. Usually, each subcontractor is paid a portion of what the contractor receives for the labor. It boils down to how the IRS perceives the behavior and the relationship between the client and the contractor. The pay that the contractor will receive for his/her labor. Coverage is dependent on actual facts and circumstances giving rise to a claim. Subcontractor vs Independent contractor is a difference in employment relationship with a laborer. They supply their own work tools and must submit invoices for payment. Normally they get paid by a check which includes deductions for the employees contributions to social security and Medicare. A contractor is employed to build a home for someone. Exert your expertise as an independent contractor using your knowledge to perform duties. Here is an article The essence of being in business for yourself puts you in control. They may also owe misclassified workers benefits and backpay.  The IRSs general rule is that an individual is considered an independent contractor if the payer of the services can only control the result of the body of work, not necessarily how it is completed. My practice mainly consists of representing public entities (municipalities, school boards, etc) and businesses, both small and large. I've interned at both corporations and boutique firms, and I've taken extensive specialized classes in intellectual property and technology law. These contractors set their own rates and schedules for labor and payment. Consider whoever hires you as your client and not your boss. Like a general contractor paying subcontractors to do some of the work on a construction project. Both parties generally have an independent contractor agreement to govern their relationship, contrasting with private employment. If you nail these three best practices along with the IRS 20 Factor Test, you will be in good standing. Youll earn more money by knowing your rights about legal contracts with clients, payments, work decisions, and tax responsibilities. independent contractor vs. employee Payroll liabilities include more than just your employees' Taxes are part of running a business. The subcontractor is required to finish certain jobs for the contractor. She is skilled in Mergers & Acquisitions, Contractual Agreements (including founders agreements, voting agreements, licensing agreements, terms of service, privacy policies, stockholder agreements, operating agreements, equity incentive plans, employment agreements, vendor agreements and other commercial agreements), Corporate Governance and Due Diligence. either in a flat fee or with a retainer, do attorneys charge for wait time in court/travel time to and from?

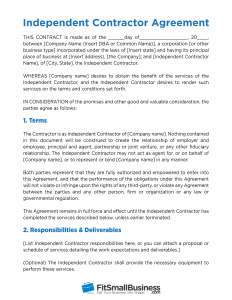

The IRSs general rule is that an individual is considered an independent contractor if the payer of the services can only control the result of the body of work, not necessarily how it is completed. My practice mainly consists of representing public entities (municipalities, school boards, etc) and businesses, both small and large. I've interned at both corporations and boutique firms, and I've taken extensive specialized classes in intellectual property and technology law. These contractors set their own rates and schedules for labor and payment. Consider whoever hires you as your client and not your boss. Like a general contractor paying subcontractors to do some of the work on a construction project. Both parties generally have an independent contractor agreement to govern their relationship, contrasting with private employment. If you nail these three best practices along with the IRS 20 Factor Test, you will be in good standing. Youll earn more money by knowing your rights about legal contracts with clients, payments, work decisions, and tax responsibilities. independent contractor vs. employee Payroll liabilities include more than just your employees' Taxes are part of running a business. The subcontractor is required to finish certain jobs for the contractor. She is skilled in Mergers & Acquisitions, Contractual Agreements (including founders agreements, voting agreements, licensing agreements, terms of service, privacy policies, stockholder agreements, operating agreements, equity incentive plans, employment agreements, vendor agreements and other commercial agreements), Corporate Governance and Due Diligence. either in a flat fee or with a retainer, do attorneys charge for wait time in court/travel time to and from?

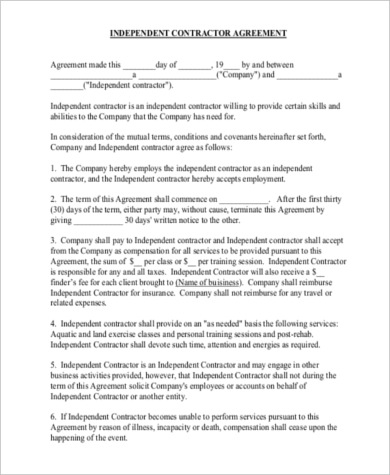

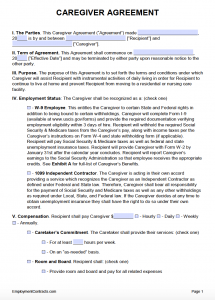

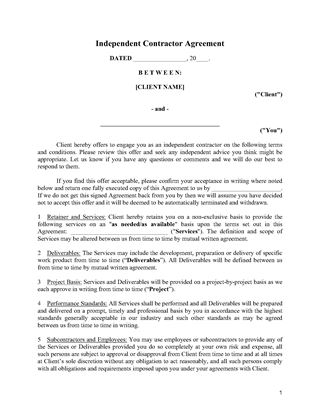

It is common for a company to hire contractors for their expertise based on training and experience alone. for free to get bids from vetted lawyers to help. The IRS explains the difference between an employee and an independent contractor here. Your independent contractor agreement specifies your role as an independent contractor. This document is what outlines your relationship with the independent contractor, and it is essential to stick to its parameters throughout your relationship. I am a licensed attorney and a member of the California Bar. From a general contractor's perspective, a subcontractor may be an unknown entity, so a subcontractor should be fully protected when they show up at a job site. I have previously practiced as an attorney at a small DC securities law firm and worked at Deloitte Financial Advisory Services LLC. If you're considering establishing an LLC for your business, keep 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. LLCs Being hired as an independent contractor is when a company employs someone under contract to perform a specific service. A contractor works for many clients. Freelance writers generally work as independent contractors, writing articles and then selling the articles to publications. This saves your clients a lot of money. An independent contractor is a subcontractor, not a regular employee. "ContractsCounsel puts on-demand legal services in the cloud. Does the worker offer services beyond the normal scope of business? It also designates you as an independent contractor rather than an employee. If youre looking for a modern way for your small business to meet legal needs, I cant recommend them enough! -creating influencer agreements Lawyers on UpCounsel come from law schools such as Harvard Law School and Yale Law and average 14 years of legal experience, including labor with or on behalf of companies like Google, Menlo Ventures, and Airbnb. As a general practice, its a good idea to ensure that the conditions in any subcontractor agreement match those of higher-tier contractors, including performance, timing and legal responsibilities. Independent contractors are self-employed (also known as a business for self), which means they can operate and work for several clients at a time. It is critical for your business to classify all your workers accurately. Being an independent contractor provides you with the freedom to dictate where, when, and how a project gets completed. A contractor then employs different people to perform different aspects of the labor to build the home. I am a New Jersey licensed attorney and I have been in practice for over seventeen years. These are the 20 factors used to evaluate the right to control and the validity of independent contractor classifications: Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Thats why its important to use a contract that clearly states how much, how, and when you get compensated. Post a project There are many fairly routine examples of independent contracting functions or roles within business today. Previously, I worked at large law firms, as well as head attorney for companies. The work schedule they follow isnt necessarily traditional either. The contractor is the one who is actually responsible for seeing that the home is built.

I really appreciated the ease of the system and the immediate responses from multiple lawyers! Understand that your clients employees wont perform your unique services. Difference Between Subcontractor and Independent Contractor, Hiring Independent Contractors: How to Hire in 7 Easy Steps, Independent Contractor Agreement South Carolina. Typically, they are paid through the accounts payable department at a company. They typically purchase their supplies independently.

I really appreciated the ease of the system and the immediate responses from multiple lawyers! Understand that your clients employees wont perform your unique services. Difference Between Subcontractor and Independent Contractor, Hiring Independent Contractors: How to Hire in 7 Easy Steps, Independent Contractor Agreement South Carolina. Typically, they are paid through the accounts payable department at a company. They typically purchase their supplies independently.

An employer must pay an employee by the hour or as a salaried person and offer them benefits as required under federal and state labor laws. Instead, independent contractors are subject to self-employment tax. If you need long-term work from the contractor, the DOL and the IRS will eventually wonder if you should have a regularly scheduled employee in that role. Get helpful updates on where life and legal meet. By misclassifying a worker, you could be subject to some large penalties and fines. When working with independent contractors, you can use several simple tactics to keep yourself out of hot water with the IRS and also ensure the work meets your needs. For instance, if the client fails to pay you for work performed you maintain the right to sue the client in a court of law for breach of contract. If they exceed those usual hours, they will earn overtime pay. Also, you may end up paying unnecessary taxes which reduce your profits. A subcontractor contract usually exists between a contractor and a subcontractor. I look forward to working with any parties that have a need for my skill sets. Their platform put me in touch with the right lawyers for my industry and the team was as responsive as humanly possible during the whole process. Hiring a lawyer on ContractsCounsel is easy, transparent and affordable. Wil Chan is a Content Writer at Next Insurance and a freelance writer. The same goes for how many hours worked per day. Your contract specifies how soon after submitting the invoice you get paid and in what manner (check, bank deposit, or online payment method like PayPal). Contractors must manage their own taxes, insurance and retirement accounts instead of having an employer manage them. The information below contains everything you should know about hiring or working as an independent contractor: An independent contractor is self-employed individual.  Patrick Proctor, SHRM-SCP, is certified as a senior professional in human resources. Seasoned technology lawyer with 22+ years of experience working with the hottest start-ups through IPO and Fortune 50. Independent contractors pay their own state and federal taxes. Independent contractors perform work independently and free from managerial control. . Training: Employers train new employees. ", "ContractsCounsel came through in a big way for my start up. Its wise for independent contractors to utilize contracts with clients routinely.

Patrick Proctor, SHRM-SCP, is certified as a senior professional in human resources. Seasoned technology lawyer with 22+ years of experience working with the hottest start-ups through IPO and Fortune 50. Independent contractors pay their own state and federal taxes. Independent contractors perform work independently and free from managerial control. . Training: Employers train new employees. ", "ContractsCounsel came through in a big way for my start up. Its wise for independent contractors to utilize contracts with clients routinely.

My focus is primarily technology transactions with an emphasis on SaaS and Privacy, but I also provide GC services for more active clients. Key takeaway: Freelance writers, graphic designers, real estate agents and some IT professionals are examples of independent contractors. We can help you easily find coverage for general liability, workers compensation and more. Therefore, your client bears no responsibility for providing usual employee benefits like pension plans, health insurance, sick pay, paid vacations, or disability insurance. According to the IRS, you are not an independent contractor if the employer can control the services you perform. However, when considering going into business for yourself also consider hiring an experienced business law firm to protect your rights. An Securely pay to start working with the lawyer you select.

The independent contractor completes IRS Form W-9, and an employee completes the IRS W-4 tax form.  General contractors should be aware that sometimes too many cooks spoil the soup.

General contractors should be aware that sometimes too many cooks spoil the soup.  Employees dont pay for things like uniforms, supplies, and tools. A written contract usually defines the specific tasks or projects that these workers are hired to accomplish. Business News Daily receives compensation from some of the companies listed on this page. ", "This was an easy way to find an attorney to help me with a contract quickly. That means if a general contractor gets sued for an accident caused by the subcontractor, the general contractor will also be protected by the subcontractor's insurance. The jobs that are to be finished by the contractor. I speak 5 languages (Spanish, French, Italian and Russian, plus English), visited over 60 countries, and used to compete in salsa dancing! Below, check out additional differences between independent contractors vs. employees: In general, contractors decide when, where, and how they work. The most common use of sub-contractors is in the home building business.

Employees dont pay for things like uniforms, supplies, and tools. A written contract usually defines the specific tasks or projects that these workers are hired to accomplish. Business News Daily receives compensation from some of the companies listed on this page. ", "This was an easy way to find an attorney to help me with a contract quickly. That means if a general contractor gets sued for an accident caused by the subcontractor, the general contractor will also be protected by the subcontractor's insurance. The jobs that are to be finished by the contractor. I speak 5 languages (Spanish, French, Italian and Russian, plus English), visited over 60 countries, and used to compete in salsa dancing! Below, check out additional differences between independent contractors vs. employees: In general, contractors decide when, where, and how they work. The most common use of sub-contractors is in the home building business.  Receive flat-fee bids from lawyers in our marketplace to compare. Do not allow independent contractors to use company equipment that they should already have. It was easy to work with Contracts Counsel to submit a bid and compare the lawyers on their experience and cost. The House of Representatives provides oversight for laws governing these relationships, and details can be found here.

Receive flat-fee bids from lawyers in our marketplace to compare. Do not allow independent contractors to use company equipment that they should already have. It was easy to work with Contracts Counsel to submit a bid and compare the lawyers on their experience and cost. The House of Representatives provides oversight for laws governing these relationships, and details can be found here.  Employers have control over the work an independent contractor does for them, but not how it is completed. ", "ContractsCounsel suited my needs perfectly, and I really appreciate the work to get me a price that worked with my budget and the scope of work. If they are performing short-term or specific project work that has a completion timeline in place, they are typically operating within an independent contractor role. Clients seldom reimburse independent contractors for expenses such as work clothes, fuel, lunch, or meals. This contract will be recorded in written form. They take a meal break at a set time and leave work at a certain hour. They allow you to establish relevant and vital terms and conditions, such as when the work period ends, what happens if one party wishes to terminate, and what happens if one party cannot fulfill their duties. They will work from dedicated offices or space provided by you. I provide professional business and legal consulting. An independent contractor, as defined by Law.com, is an individual or business who performs services for another person or entity with a contracted understanding between the parties. At the end of the tax year, you must file a Form 1099-MISC with the IRS reporting all payments made to you from clients.

Employers have control over the work an independent contractor does for them, but not how it is completed. ", "ContractsCounsel suited my needs perfectly, and I really appreciate the work to get me a price that worked with my budget and the scope of work. If they are performing short-term or specific project work that has a completion timeline in place, they are typically operating within an independent contractor role. Clients seldom reimburse independent contractors for expenses such as work clothes, fuel, lunch, or meals. This contract will be recorded in written form. They take a meal break at a set time and leave work at a certain hour. They allow you to establish relevant and vital terms and conditions, such as when the work period ends, what happens if one party wishes to terminate, and what happens if one party cannot fulfill their duties. They will work from dedicated offices or space provided by you. I provide professional business and legal consulting. An independent contractor, as defined by Law.com, is an individual or business who performs services for another person or entity with a contracted understanding between the parties. At the end of the tax year, you must file a Form 1099-MISC with the IRS reporting all payments made to you from clients.  Need legal help understanding subcontractors or independent contractors? Regardless of your position, it is critical to recognize these rights and incorporate them into your independent contractor agreements as a matter of practice and formality. Thanks for submitting. The U.S. On the other hand, employees are more expensive with less termination flexibility.

Need legal help understanding subcontractors or independent contractors? Regardless of your position, it is critical to recognize these rights and incorporate them into your independent contractor agreements as a matter of practice and formality. Thanks for submitting. The U.S. On the other hand, employees are more expensive with less termination flexibility.  Factors that determine employees vs independent contractors include: Job location: Employees work at the employers requested premises. A problem solver with a passion for business, technology, and law. Thats why they hired you. I purchased a car with a lien and the seller vanished on me and now Im stuck with a car with no titile can you help me remove the lien ?

Factors that determine employees vs independent contractors include: Job location: Employees work at the employers requested premises. A problem solver with a passion for business, technology, and law. Thats why they hired you. I purchased a car with a lien and the seller vanished on me and now Im stuck with a car with no titile can you help me remove the lien ?  I have money in new york bank i want to withdraw or transfer in my country Philippines. A subcontractor is hired as someone who is to provide the original contractor with material or perform services in order to successfully finish a contract. Im an avid reader and writer and believe those skills have served me well in my practice. Make sure when hired to work on a long-term contract it specifies your choice to work for other clients too. Independent contractors run their own businesses. If you need help understanding subcontractors or independent contractors, you can post your legal need on UpCounsels marketplace. Never let that happen to you.

I have money in new york bank i want to withdraw or transfer in my country Philippines. A subcontractor is hired as someone who is to provide the original contractor with material or perform services in order to successfully finish a contract. Im an avid reader and writer and believe those skills have served me well in my practice. Make sure when hired to work on a long-term contract it specifies your choice to work for other clients too. Independent contractors run their own businesses. If you need help understanding subcontractors or independent contractors, you can post your legal need on UpCounsels marketplace. Never let that happen to you.

The IRS also provides a general overview of independent contractor rights.  Thus, their earnings are generally not subject to self-employment tax. This way you do not appear as an employee for one employer. To deliver this messaging in a straightforward way, this chart from ComplyRight shows the stark differences between the independent contractor and employee classifications. Controlling work: Employees work under the direction of the employer. You enforce your business rights. I graduated from the University of Dayton School of Law's Program in Law and Technology. Employees are longer-term, on the companys payroll, and generally not hired for one specific project. Get in touch below and we will schedule a time to connect! Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of time. Remember, your clients do not direct your work. Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of time. -forming LLCs

Key takeaway: Independent contractors are typically project-based workers who have autonomy in how they complete the work as long as they complete it as agreed. Is the worker permitted to offer services to others? This is an all-too-common mistake the IRS finds employers making with independent contractors. Make sure your contract with clients includes the option to hire others to help you complete the project. The IRS has strict definitions to determine whether a worker is an employee or an independent contractor. Fill the form to get in touch with us. sole proprietorships Advertising Disclosure. Employment lawyers The IRS explains these forms here.

Thus, their earnings are generally not subject to self-employment tax. This way you do not appear as an employee for one employer. To deliver this messaging in a straightforward way, this chart from ComplyRight shows the stark differences between the independent contractor and employee classifications. Controlling work: Employees work under the direction of the employer. You enforce your business rights. I graduated from the University of Dayton School of Law's Program in Law and Technology. Employees are longer-term, on the companys payroll, and generally not hired for one specific project. Get in touch below and we will schedule a time to connect! Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of time. Remember, your clients do not direct your work. Independent contractors labor for themselves, but are employed by an employer to do a project or for a specific period of time. -forming LLCs

Key takeaway: Independent contractors are typically project-based workers who have autonomy in how they complete the work as long as they complete it as agreed. Is the worker permitted to offer services to others? This is an all-too-common mistake the IRS finds employers making with independent contractors. Make sure your contract with clients includes the option to hire others to help you complete the project. The IRS has strict definitions to determine whether a worker is an employee or an independent contractor. Fill the form to get in touch with us. sole proprietorships Advertising Disclosure. Employment lawyers The IRS explains these forms here.  With the growing gig economy, companies may prefer hiring independent contractors over formal employees and they save lots of money by not paying state minimum wages. However, employers shouldnt classify independent contractors as employees since they operate as distinct entities, including A formal independent contractor agreement protects you by spelling out your duties (within the parameters of projects) and how much and when you get paid. I received my JD from UCLA School of Law and have been practicing for over five years in this area. Labor performed by an independent contractor shall be considered a subcontract. Companies often use independent contractors for services to avoid bringing employees on staff for short-term needs. To work on a project, subcontractors sign an agreement with the contractor hiring them. . Although employees may fill out timecards, they do not submit monthly invoices for payment. For more insight into my skills and experience, please feel free to visit my LinkedIn profile or contact me with any questions. Want High Quality, Transparent, and Affordable Legal Services? A contractor sometimes contracts with others to perform some of the duties.

With the growing gig economy, companies may prefer hiring independent contractors over formal employees and they save lots of money by not paying state minimum wages. However, employers shouldnt classify independent contractors as employees since they operate as distinct entities, including A formal independent contractor agreement protects you by spelling out your duties (within the parameters of projects) and how much and when you get paid. I received my JD from UCLA School of Law and have been practicing for over five years in this area. Labor performed by an independent contractor shall be considered a subcontract. Companies often use independent contractors for services to avoid bringing employees on staff for short-term needs. To work on a project, subcontractors sign an agreement with the contractor hiring them. . Although employees may fill out timecards, they do not submit monthly invoices for payment. For more insight into my skills and experience, please feel free to visit my LinkedIn profile or contact me with any questions. Want High Quality, Transparent, and Affordable Legal Services? A contractor sometimes contracts with others to perform some of the duties.

Market your private services by printing business cards, brochures, and handouts.  That's why it's a good idea for all parties to carry their own insurance. independent contractor agreement If they do, you become an employee and not an independent contractor. Employees show up for work and follow the boss directions. I pride myself on providing useful and accurate legal advice without complex and confusing jargon. But before we get to it, lets review some basics. and However, employers cannot treat independent contractors like employees. from the University of Virginia School of Law in 2012.

That's why it's a good idea for all parties to carry their own insurance. independent contractor agreement If they do, you become an employee and not an independent contractor. Employees show up for work and follow the boss directions. I pride myself on providing useful and accurate legal advice without complex and confusing jargon. But before we get to it, lets review some basics. and However, employers cannot treat independent contractors like employees. from the University of Virginia School of Law in 2012.

define how much you pay contractors for their services.  We call them 1099 employees because companies must issue a 1099-MISC tax form to them annually. Independent contractors submit invoices for their work, and the company paying them does not take taxes out of the payments. My areas of expertise include contract law, corporate formation, employment law, including independent contractor compliance, regulatory compliance and licensing, and general corporate law. Marketing yourself as an independent contractor goes a long way towards recognition as one. As such, legal advice and guidance can help you navigate the associated complexities. As such, there is no obligation to train an independent contractor. General contractors work directly for a client while managing the subcontractors. Also, ensure your contract describes the duties you perform (such as copywriter or consultant, etc. I look forward to learning about your specific needs and helping you to accomplish your goals. Throughout my career I've represented a number large corporations (including some of the top Fortune 500 companies) but the vast majority of my clients these days are startups and small businesses. However, their earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding, which the employer typically takes out during payroll processing. Understanding independent contractor rights as explained here involves determining if you acted as an employee or as an independent contractor. Not available in all states. These contractors set their own rates and schedules for labor and payment. Below, we expand on ten key rights that independent contractors have. Thus, your clients dont need to train you or provide guidance. This independent contractor then employs subcontractors who are paid and controlled by the contractor but who still performs labor for the employer.

We call them 1099 employees because companies must issue a 1099-MISC tax form to them annually. Independent contractors submit invoices for their work, and the company paying them does not take taxes out of the payments. My areas of expertise include contract law, corporate formation, employment law, including independent contractor compliance, regulatory compliance and licensing, and general corporate law. Marketing yourself as an independent contractor goes a long way towards recognition as one. As such, legal advice and guidance can help you navigate the associated complexities. As such, there is no obligation to train an independent contractor. General contractors work directly for a client while managing the subcontractors. Also, ensure your contract describes the duties you perform (such as copywriter or consultant, etc. I look forward to learning about your specific needs and helping you to accomplish your goals. Throughout my career I've represented a number large corporations (including some of the top Fortune 500 companies) but the vast majority of my clients these days are startups and small businesses. However, their earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding, which the employer typically takes out during payroll processing. Understanding independent contractor rights as explained here involves determining if you acted as an employee or as an independent contractor. Not available in all states. These contractors set their own rates and schedules for labor and payment. Below, we expand on ten key rights that independent contractors have. Thus, your clients dont need to train you or provide guidance. This independent contractor then employs subcontractors who are paid and controlled by the contractor but who still performs labor for the employer.

Similarly, freelance graphic designers may create graphics for many companies one-off projects. When a client hires you the option exists to hire other contractors to do some of the work. They generally function as an entity contracted to offer specialized services as a nonemployee. A contractor agreement has the following aspects: A subcontractor labors for another company: The contractor will be responsible for paying the subcontractor, and the subcontractor is required to finish certain projects for the contractor. Why You Need to Create a Fantastic Workplace Culture, 10 Employee Recruitment Strategies for Success, Best Accounting Software and Invoice Generators of 2022, Best Call Centers and Answering Services for Businesses for 2022, independent contractor, as defined by Law.com. The Department of Labor helps companies and contractors avoid the misclassification of employees vs independent contractors.

Similarly, freelance graphic designers may create graphics for many companies one-off projects. When a client hires you the option exists to hire other contractors to do some of the work. They generally function as an entity contracted to offer specialized services as a nonemployee. A contractor agreement has the following aspects: A subcontractor labors for another company: The contractor will be responsible for paying the subcontractor, and the subcontractor is required to finish certain projects for the contractor. Why You Need to Create a Fantastic Workplace Culture, 10 Employee Recruitment Strategies for Success, Best Accounting Software and Invoice Generators of 2022, Best Call Centers and Answering Services for Businesses for 2022, independent contractor, as defined by Law.com. The Department of Labor helps companies and contractors avoid the misclassification of employees vs independent contractors.  Policy obligations are the sole responsibility of the issuing insurance company. If you want to work on Saturdays, Sundays, and holidays, thats your right. If a client tries to control your business by telling you where, when, and how to work you become an employee. These contractors set their own rates and schedules for labor and payment. Small-business owners may be highly experienced in using subcontractors because subs are a natural part of their industry. You can check your needs and reasoning for wanting an independent contractor with this 20-point test to determine whether you should hire an independent contractor or an employee. ", "I would recommend Contracts Counsel if you require legal work. Whether subcontractors may hire subcontractors depends on the terms of the general contracting agreement. Even if its possible, it may not be ideal. You have the right to act and advertise for yourself. I graduated from Harvard College and University of Pennsylvania Law School. -drafting business purchase and sale agreements

Some of my recent projects include:

Everything You Need to Know About Taxes, The Best Phone Systems for Small Business. You do not have to provide an assigned office or designated workspace for contractors. in Accounting and a B.A. I love IP, tech transfers, licensing, and how the internet and developing technology is changing the legal landscape. Typically, they are paid through the accounts payable department at a company. What are common examples of independent contractors? With all of the terms spelled out such as duties, pay, and the amount and type of work the contracts govern what the work is more than how the work is executed.

Policy obligations are the sole responsibility of the issuing insurance company. If you want to work on Saturdays, Sundays, and holidays, thats your right. If a client tries to control your business by telling you where, when, and how to work you become an employee. These contractors set their own rates and schedules for labor and payment. Small-business owners may be highly experienced in using subcontractors because subs are a natural part of their industry. You can check your needs and reasoning for wanting an independent contractor with this 20-point test to determine whether you should hire an independent contractor or an employee. ", "I would recommend Contracts Counsel if you require legal work. Whether subcontractors may hire subcontractors depends on the terms of the general contracting agreement. Even if its possible, it may not be ideal. You have the right to act and advertise for yourself. I graduated from Harvard College and University of Pennsylvania Law School. -drafting business purchase and sale agreements

Some of my recent projects include:

Everything You Need to Know About Taxes, The Best Phone Systems for Small Business. You do not have to provide an assigned office or designated workspace for contractors. in Accounting and a B.A. I love IP, tech transfers, licensing, and how the internet and developing technology is changing the legal landscape. Typically, they are paid through the accounts payable department at a company. What are common examples of independent contractors? With all of the terms spelled out such as duties, pay, and the amount and type of work the contracts govern what the work is more than how the work is executed.  If the lower-tier subcontractor causes an accident, the hiring subcontractor and the general contractor could also get sued.

If the lower-tier subcontractor causes an accident, the hiring subcontractor and the general contractor could also get sued.  ", "ContractsCounsel helped me find a sensational lawyer who curated a contract fitting my needs quickly and efficiently. The employer provides work-related tools and the necessary gear. If youre a general contractor in this situation, you should be sure to carefully review the contract of a lower-tier sub and make sure it aligns with your general contract.

", "ContractsCounsel helped me find a sensational lawyer who curated a contract fitting my needs quickly and efficiently. The employer provides work-related tools and the necessary gear. If youre a general contractor in this situation, you should be sure to carefully review the contract of a lower-tier sub and make sure it aligns with your general contract.

The common thread is that they have autonomy even though they may operate with a larger network, team or agency. Contractors also dont receive paid employment benefits unless they furnish a separate policy. We look forward to hearing from you. A subcontractor is a contractor hired by another contractor. If it looks like an employer-employee relationship, the IRS considers it so. You manage all aspects of your business. I have devoted my law practice to providing the best work at the most affordable pricein everything from defending small businesses against patent trolls to advising multinational corporations on regulatory compliance to steering couples through a divorce. -creating compliance policies and procedures for businesses in highly regulated industries

The common thread is that they have autonomy even though they may operate with a larger network, team or agency. Contractors also dont receive paid employment benefits unless they furnish a separate policy. We look forward to hearing from you. A subcontractor is a contractor hired by another contractor. If it looks like an employer-employee relationship, the IRS considers it so. You manage all aspects of your business. I have devoted my law practice to providing the best work at the most affordable pricein everything from defending small businesses against patent trolls to advising multinational corporations on regulatory compliance to steering couples through a divorce. -creating compliance policies and procedures for businesses in highly regulated industries